If you are a business looking for the best payroll software to ensure your payroll is running smoothly, getting your employees paid on time, and filing your taxes correctly, all for an affordable price, our Best Payroll Software of 2022 rating is here to help.

Your employees come to work to receive compensation. Therefore, correct and timely payment of employees contributes to employee satisfaction and retention.

However, without the correct software, the actual processing of payroll can be difficult for your payroll administrator. The best free payroll software is user-friendly and automatically calculates state and federal taxes.

The best payroll software is economical and adaptable to your organization’s pay structure and expanding needs, regardless of the size of your crew. We evaluate the best payroll software currently available on the market.

What is Payroll Software?

Payroll software is a tool that computes an employee’s earnings based on the number of hours worked and the wages set. It also reserves the proper amount for payroll taxes, including federal, state, and municipal requirements.

Manually processing payroll leaves a lot of possibility for error, which can result in costly IRS fines. As a result, many businesses opt to outsource payroll, even though doing so can be expensive. Best Payroll software for employees is an economical solution that helps companies manage compliance, allowing them to avoid fines and legal action.

Best Payroll Software

Payroll Software list: We considered seven payroll solutions to help you choose the right payroll software for your business.

1. Gusto

Best for Small Businesses

Lets talk about the best HR and payroll software For Businesses. Gusto, known initially as ZenPayroll, was created to assist small businesses in managing their teams through a unified platform. Gusto is an excellent option for expanding teams that wish to send professional offer letters, offer 401(k)s, and provide additional benefits. The service provides clients with three plan options: Simple, Plus, and Premium.

The Simple package is ideal for small businesses that want to handle payroll efficiently and affordably. It costs $40/month plus $6 per individual. The Plus package includes extra tools such as time monitoring and the capacity to manage PTO requests. The subscription fee for the Plus package is $80 per month, plus $12 per employee per month.

The Premium package includes HR support for all payroll functions. It is an excellent solution for mid-sized businesses without an HR department or a small one, as Gusto’s HR professionals will be available when needed. Contact Gusto for pricing information on this package.

2. Paychex

Best for Large Businesses

You can import payroll into Paychex’s software or manually enter it. Paychex, founded in 1971, gives every client a Learning Management System that provides online courses for employees to acquire new skills and boost employee retention. In addition, the software supports seamless 401(k) integration, automatically calculates your federal, state, and local taxes, and offers a free mobile app.

This best payroll software for large business offers 3 packages: Paychex Flex Essentials, Paychex Flex Select, and Paychex Flex Pro. Learning management systems are included in the Paychex Flex Select and Paychex Flex Pro packages. In addition, if you choose Pro, you can access numerous other services, like onboarding, employee screening, and a handbook builder.

Paychex is an excellent option for larger companies or companies that desire the payroll expertise of a larger organization. The monthly cost of the Paychex Essentials package is $39 plus $5 per employee. Since rates for the other two plans are not posted on the website, businesses need to contact Paychex to acquire quotations.

3. Square

Best Overall

Square began with a square-shaped credit card reader and a tablet cash register, hence the company’s name. Since then, though, it has expanded to offer various business-facilitating tools, including payroll software.

The payroll software free provided by Square enables employers to pay full-time employees and contractors, log hours easily, and pay hourly and salaried employees. The company promotes its software as an “all-in-one solution” that enables employers to provide health insurance and handles payroll tax filings and withholdings. A mobile app also allows managers on the road to pay employees from anywhere.

You will pay $35 per month for the software subscription and an additional $5 per user. Square is among the best payroll software because it is adaptable to businesses of any size and allows for customization of how and when employees are paid.

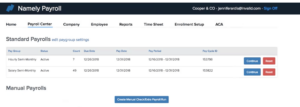

4. Namely

Best Cloud-Based

If we talk about the Best Online Payroll Services for 2022, Namely was founded in 2012 to “provide an HR platform as user-friendly as social media” Namely offers HR and payroll integration through its cloud-based platform, allowing employees to access payroll from any location. This program is optimal for companies with at least 50 employees, according to a spokesperson of the company, which stated that it supports companies with up to 120,000 workers.

The platform handles all taxes, compliance, and reporting at the end of the year. Add services that assist with benefits, recruitment, and onboarding. The program functions to distribute employee surveys around an organization to collect feedback. Namely does not provide pricing information online; therefore, businesses must contact the company directly for a quote. Namely is a robust all-in-one solution for mid to large-sized companies seeking a single, cloud-based HR app that meets all of their demands.

5. QuickBooks

Best Value

Next in our list of the Best Payroll Software Systems is QuickBooks. It from Intuit is an excellent option if your pay structure does not change frequently and your budget is tight. Through auto-pay, payroll can be processed automatically after initial setup. You will receive updates via notifications, but you can essentially set it and forget it. In addition, QuickBooks offers tax penalty protection, resolving problems and paying associated penalties on your behalf. Additionally, even time tracking can be automatically synced with payroll using QuickBooks.

QuickBooks’ same-day direct payment for employees and contractors is a charming feature of the top two options. It helps you retain funds for a more extended period and expedites employee employees.

QuickBooks has three primary packages, Core, Premium, and Elite, with discounts of up to 50% for the first three months. Core provides:

- Automatic payroll.

- Processing of health benefits.

- Next-day direct deposit for $45/month ($22.50 per month for the first three months) plus $4 per employee.

The Premium plan includes:

- Automatic payroll.

- Same-day direct deposit.

- Mobile time tracking.

- An HR support center for $75/month ($37.50 per month for the first three months) plus $8 per employee.

The Elite package includes everything Premium does in addition to a “white-glove” setup, tax penalty protection, and a personal HR advisor for $125 per month ($62.50 per month for the first three months), plus $10 per employee per month.

6. Zenefits

Best Package

Are you still seeking the Best payroll software for small business in 2022? Zenefits, which started as an HR platform, syncs its payroll with its existing HR platform. Benefits, paid time off, hour tracking, and compensation adjustments are centralized. For instance, users only need to submit an employee’s wage change once, which will sync immediately to payroll and other platform areas. The drawback with Zenefits is that you must first acquire the HR software; payroll is an add-on. Although the payroll feature is new, it is quickly becoming an industry standard.

There are three standard packages of the HR platform that run from $10 to $27 per employee per month (however, annual pricing reduces the price to $8 to $21 per month). Adding payroll costs an additional $6 per employee per month. In addition, it automatically computes payroll taxes, garnishment support, direct deposit, mobile payments, and the capability to pay using numerous pay structures.

Other benefits include employee lifetime access to their portal, even after they’ve left the organization, and job cost reports for management to understand how payroll expenses are split among various labor kinds.

7. RUN powered by ADP

Best Legacy

Looking for payroll options beyond a startup? ADP has managed payroll for almost seven decades and is an industry leader. RUN powered by ADP offers simple software that helps customers swiftly onboard new employees, whether full-time or independent contractors. In addition, users can do payroll using their smartphones or online.

ADP’s offerings are separated into those for businesses with 1-49 employees and those with 50-999 employees. Smaller businesses have four options: Essential Payroll, Enhanced Payroll, Complete Payroll & HR Plus, and HR Pro Payroll & HR. There are also four choices for larger businesses: Payroll Essentials, HR Plus, Hiring Advantage, and Performance Plus. ADP does not publish its costs online and requires you to contact a representative for an estimate. You may be eligible for three free months of service.

ALSO SEE: Accounting Software for Mac

The technology allows employees to see their pay stubs and taxes using their login credentials. In addition, ADP ensures the security of business owners by keeping them abreast of evolving HR regulations and payroll requirements.

FAQs

What Can a Payroll Software Do?

The best payroll software for businesses can automatically pay your workforce and distinguish between pay structures. As the number of start-up tech payroll companies increases, more provide HR-integrated software. It enables your organization to handle time tracking, paid time off, benefits, and more on a unified platform. Numerous platforms also have employee logins, allowing your team members to monitor their pay, taxes, and other information.

Is Paying for Payroll Software Worth It?

Good payroll software is well worth the cost. Investing in payroll software can save the time required to collect W-4s, calculate and withhold income taxes, and pay employees’ taxes, even if you have an accountant on staff. However, it is doable but time-consuming, prone to error, and could result in severe penalties if done incorrectly.

Chose the Best Payroll Software Companies

We selected these companies as having the best small business payroll software on the market based on user-friendliness, adaptability, and customer service. In today’s economy of flexible employment, the ability to process payroll from anywhere is essential. Thus, cloud-based platforms or those that provide an app topped our list. In addition, companies that provided HR support, assistance with payroll setup, or incorporated HR services also ranked highly on the list.

Companies that made it easy for employers to pay contractors and full-time and part-time employees also ranked highly.